The impressive oil discoveries in the so called Brazilian Pre-salt (2007) have created a new reality in the oil & gas industry.

In order to keep up with such a woderful discovery, the Brazilian Oil & Gas industry (mostly PETROBRAS) successfuly faced a significant technology challenge trhough the end of that decade.

The 2 main challenging factors to overcome were and still are:

- the distance of the reserves from the coast,

- the high water depth and the complexity of the reservoirs.

The logistical effort will intensify with many new production systems. This scenario will require a significant change in the way processes are managed. The major challenges to the implementation of future Pre-salt petroleum platforms is redesigning the processes to this new reality, where the complexity will require offshore processes carried out in a simple, safe and efficient way.

In the traditional working processes, the production control is on board the petroleum platform, done by professionals dedicated exclusively to the operation of the production plant in supervisory control rooms.

As per the operationalization of the Pre-salt, the offshore process plant will be remotely controlled from the onshore base, in collaborative environments located in the company´s offices.

In general, a petroleum platform receives fluids from wells, separates gas, oil and water and exports these phases through pipelines or vessels. Every processing plant is controlled by the supervisory system team. Due to the challenges of the oil industry, many initiatives have been implemented to bring onshore all the work that doesn’t need to be done onboard the platforms, in order to lower the human exposure to the risks involved in production operations, reduce trips to the offshore unit and increase the availability of experienced experts.

It’s possible to provide a better management of the activities, using a centralized mode, also decreasing operational costs. The production development of these oil fields requires an increasing number of operational activities onshore, including the remote operation of production units. This work process, redesigned to integrate people and information, is part of a worldwide policy of the offshore operators. There is a multiplicity of names to the Digital Oil Field, coined by oil companies, some of which are Digital Oil Field of the Future, Smart Fields, Smart Wells , iField, iWells, eField, and Intelligent Field (Cramer et al, 2012).

Santos Basin is one of the largest Brazilian sedimentary basins, where important oil fields were discovered by a major energy company, with a huge production potential in ultra-deep waters. This area is located Southeastern Brazil and known for the oil reservoirs in the Pre-salt. Because the distance from the coast is greater than 300 km and the complexity of the wells, the production development of these oil fields presents technological challenges, such as telecommunication and logistics, which usually require work processes redesign and an increasing number of operational activities to be carried out in the onshore offices.

In traditional working processes, operation and supervision of the production plant are conducted on the offshore production platform by professionals exclusively dedicated to operation, in local supervisory control rooms.

The main motivation for remote operations is to reduce operating costs with the implementation of new projects. Remote operations have been implemented in the oil and gas industry, with significant progress made through workflow and process design, enabling remote monitoring, execution, and control (Breu, 2007). According to Levett (2006), the main result of integrated operations is a large number of onshore operation centers, with the goal to increase safety, reduce costs, enhance collaboration and promote better decisions. The point is to make real-time data available anywhere and to support this extended data access with work processes for optimum operation.

Because of the high response time present in satellite systems, the world’s oil companies consider fiber optics telecommunications infrastructure as a premise for performing remote operations. Skourup et al (2008) completes that operating earnings from this type of operation justify the execution of telecommunication projects with low latency and high availability systems.

Understanding the delay performance characteristics of packet switched networks greatly facilitates delay performance analysis of net computing systems. This is particularly important to grid applications with low latency requirements. The protocol network analyzer flows generated from distinct sources merge together and compete with each other to access available bandwidth from the outgoing links at the packet switches (Falk & Fries, 2009).

While the optical net is not deployed, the biggest challenge for remote operation of future Pre-salt platforms is the infrastructure of telecommunications networks, currently served by dedicated satellites, whose intrinsic latency characteristics influence transactions between the supervisory system, remote environment on land and the oil platform system.

The most common supervisory system in the oil industry is SCADA (Supervisory Control and Data Acquisition). It is responsible for controlling the entire production plant. To represent a real scenario, the delay in the logical sequencing of an operational action, open à close à open, by a remote SCADA system, can change the conditions specified for the product (oil or gas) even may create risks considering operations with high pressures and temperatures. Situations such as sequencing error, caused by variation in latency communication between SCADA systems, may bring the platform interlocking system to perform a plant partial or total shutdown, causing considerable production losses.

Thus, a better understanding of the behavior of the satellite network latency variations can help in the design, choosing of more appropriate protocols and infrastructure, avoiding negative impact on the performance of remote operations.

A method of analysis of the latency variation of messages exchanged by SCADA System, between the remote environment onshore and the petroleum platform, in satellite transmissions, would use three real operational situations from supervisory actions, such as: (1) chemicals injection pump of the submarine system switch, (2) verification of the vessel level after the shutoff valve operation and (3) identification of an event generated by the inert gas detection system. There is no interdependence of the controls, only an increase of complexity in the execution, so that it was possible to evidence the successful realization of the supervisory actions.

This study would also quantify the effect of the variability of latency in each situation above and maybe eventually identify the platforms with service conditions in telecommunications infrastructure. This step is mandatory to execute the remote operations model and to help in the definitions of the requirements needed to improve it.

This architecture can be applied for other operations segments in this industry. The originality of this research is based on the analysis of the latency supported by statistical parametric tests. In that way, it was possible to present a telecommunication solution to an oil platform remote operations scenario, where the fiber optics infrastructure was not in place.

This work contributes in supporting the development of additional mechanisms for reducing the transmission delay or allow remote operation over high latency telecommunications systems, which is a recent case in the oil and gas industry. Furthermore, the proposed architecture model could be used for other needs of remote operations, as in the drilling rigs segment, ship ballast control systems and moorings, dynamic positioning, among others. In the remote operations analyzed by Skourup et al (2008) and Levett (2006), the communication systems requirements assume having low variation in latency. Unlike a laboratory test in which all the variables might not be considered, the real scenario of high latency analyzed by this work provides an operational model to remotely operate a number of applications that rely on satellite system as the transmission technology.

2. Theoretical Background

According to Boon & Fook (2003), the advantages of remote operations on an oil platform are related to the operational availability of the unit improvement, reducing the operator’s response time to restore the operation in case of unexpected downtime shutdown and the optimization of required personnel work by the introduction of automated process control systems, contributing to increase operational safety. According to Levett (2006), the benefits of remote operations for oil and gas production platforms are abound, such as: reducing operating and maintenance costs, reaching the limits between 15-20% of the value estimated for the maintenance by professionals on board, less production shutdowns caused by instrumentation problems, operational safety increase by preventive maintenance of critical equipment, alignment of the operation and other petroleum specialties (engineering, automation, reservoirs and lifting), giving a boost to the effective implementation of collaborative centers. This brings value to the operation, optimization and maintenance experts, which can remotely help in the operation of several platforms. In an oil platform local control room, a set of systems can be found. SCADA Systems are important on the monitoring of the production processes information and also the physical facilities, made by the

acquisition, handling and presentation of process and control/actuation variables to the users (Junior, 2006). Figure 1 shows the communication architecture of a SCADA System on a platform. SCADA nodes, which communicate with a Programmable Logic Controllers (PLC), are represented at the lower part and the terminal server is shown in the middle of the figure. The clients of the terminal servers are The Campos Basin is the main sedimentary area already explored off the Brazilian coast. It ranges from the outskirts of Vitoria (state of Espírito Santo) to Arraial do Cabo, off the northern coast of Rio de Janeiro, an area or approximately 100,000 square kilometers. It was in this huge open-air laboratory that we tested the main offshore technologies used to develop projects to produce at water depths never before reached in the world. The first field that was discovered with commercial volume in the Campos Basin was Garoupa, in 1974, at a depth of 124 meters. In the following year, we found the Namorado field, and, in 1976, Enchova. That was the beginning of a long series of discoveries. The path was the sea: on August 13, 1977, offshore commercial production got underway at Enchova, in the Campos Basin.

One of our innovations in these fields was the installation of the first anticipated production system on a floating platform. With it, we reduced the lead time from four to six years to a mere four months.We gained efficiency, operational flexibility, and made huge savings in investments. This allowed us to start producing oil while the definitive, fixed platforms, which would later be installed, were still being built.

It was the development of these systems that allowed us to later lift oil from deep and ultra-deep waters.

In 1984, we discovered Brazil’s first giant field in deep waters, Albacora. Later came other giant fields, such as Marlim, Roncador, Barracuda, and Caratinga.

More large fields were discovered in the northern part of the basin, already in the state of Espírito Santo: Jubarte and Cachalote, in the area that became known as “Parque das Baleias” (Whale Park).

In November 2007 Brazil’s national oil company, Petrobras, shocked the E&P world by announcing a 5-to-8-Bbbl discovery in a completely unknown geological play: carbonate reservoirs below a 2-km layer of salt, offshore Brazil, in a 2,000-m water depth. This announcement marked the beginning of a complete turnaround in the history of Brazil’s oil and gas (O&G) industry—“the pre salt era,” Fig. 1.

Technology enables exploration. This discovery resulted from more than 15 years of amazing achievements carried out by Petrobras’ Research & Development Center (CENPES), mostly in geology, geophysics, and drilling technologies. It took six years for Petrobras to hit the first “jackpot” after acquiring offshore exploratory acreage in an open bidding round during 2000. This is understandable, given that since the Brazilian Petroleum Law of 1997, the Petrobras monopoly in the O&G sector ceased to exist, in the entire value chain (note: distribution and retail sale of oil products have never been a monopolistic activity in Brazil).

Technologies needed to map potential pre-salt fields have been developed since the 1990s in CENPES. The exploratory acreage, where the pre-salt fields were discovered from 2006 onwards, was acquired in bidding rounds during 2000 and 2001, and promoted by Brazilian regulatory agency ANP, which was created within the context of the new Petroleum Law. And after this first jackpot in 2006, Petrobras intensified its exploratory activity in the area, and it had almost 100% success—for every well drilled, a new prospect was uncovered.

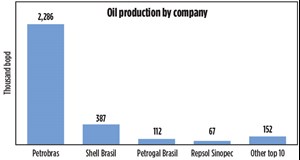

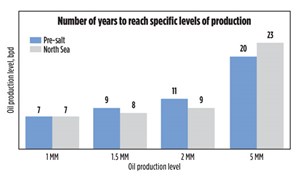

Significant results. Between 2007 and 2012, Petrobras, as operator of consortiums that owned the E&P rights for a dozen exploratory areas in this new frontier, had to deploy an aggressive appraisal plan for the entire area, drilling more than 20 wells in this period. Billions of barrels of recoverable reserves were discovered, and in 2010, oil production started. Just 10 years later, in 2019, pre-salt production reached 1.8 MMbopd, an undisputed achievement in offshore O&G history. And since the pre-salt is being developed in consortia that have Petrobras as operator most of the times, and other IOCs as partners, it is natural that Petrobras’ share of national production decreases. It was approximately 98%, when the Petroleum Law of 1997 was passed, Fig. 2.

There are other amazing numbers. Nineteen FPSOs have been installed in this period, with average well production of 22,000 bopd in December 2019, and the highest individual well flowrate was an unprecedented 47,000 bopd in an ultra-deepwater field. Even after the coronavirus pandemic and its yet uncertain impacts in the O&G industry, it was possible that pre-salt production could reach 5 MMbopd by 2030, given the expected addition of 15 to 20 new FPSOs in the pre- salt area, without considering fields that are in the exploratory phase.

It was, and will continue to be, a remarkable achievement for the global O&G industry. Brazil would hardly be a relevant O&G global player today, if it weren’t for the pre-salt discoveries and development (and yet-uncovered potential). But as weird as it may seem, from a broader perspective, the current success could be much more impressive. The “pre salt era” so far has travelled a very bumpy road. And, it is not clear if it will become a smooth freeway going forward.

BRAZIL’S ECONOMY IN THE PRE-SALT ERA

It is not unusual for NOCs that have access to a large O&G resource base to become an instrument for the government to deploy its agenda for the economy. The Petroleum Law approved under a liberal regime established some conditions that created “mandatory local content” in upstream capex. Local content became a relevant component in the bidding processes for exploratory acreage, and the commitments made voluntarily by the bidding participants increased very quickly in a short period of time. The left-wing federal government that ruled Brazil in the beginning of the pre-salt era sought to reshape the Brazilian economy through the O&G sector, as part of an extreme nationalist agenda, which in the end did not deliver the expected results.

Supply chain/local content issues. Conceptually, the idea that a local supply chain will be created, if the demand for goods and services exists, has proven to be non-applicable to Brazil. Brazil is a challenging country in which to make decent profitable investments. For example, it applies a high tax burden on productive investments. The local content model, apart from having set very high commitments over a very short term (differently than other countries where this process was smoother), was probably flawed in its conception. It could have been much more effective as an incentive rather than an obligation.

For example, a local content program, in which the overarching idea was to “do more than a minimum commitment and accumulate waivers for other projects” (e.g. lower local content requirements or even some tax waivers) could have been more successful. It also could have been directed to operations and not just investments, as well as to other parts of the value chain, not only upstream. Indeed, it seems that a “shadow local content commitment” in other parts of the value chain was applied as a “voluntary” effort, especially by Petrobras.

By enforcing the local content regulation as a means for a higher purpose, problems started to appear. As mentioned, the Brazilian economy does not provide what could be labeled as “expected competitiveness” for newcomers. The billion-dollar questions at the time were “How much longer will it take to efficiently develop projects in Brazil? How much higher will be the Capex, if compared to international providers? And, will the quality be the same?”

The market never believed that the cost of the local learning curve would be smooth. Also, the number of “creative ideas” that were put forth by the government and Petrobras have led to big problems—the “shipyards program” is perhaps the best example. Petrobras created a demand for almost 30 high-tech drilling rigs to be built in Brazil (a first time-ever endeavor) and several FPSOs for the pre-salt in the longer term. In addition, shuttle tankers were needed for moving crude oil and oil products.

Inadequate capabilities. The model was conceived to be Brazilian companies associated with experienced shipyards, especially from the Far East. The results? Not a single drilling rig or FPSO was ever 100%-built in Brazil. This program was specially affected by the “car wash” investigation that uncovered corruption schemes in this case, and in many other parts of the Brazilian O&G market. In the end, the first half of the 2010s was quite disappointing in terms of O&G supply chain development in Brazil, and crude oil production grew at a very slow pace, compared to the existing potential. Given this crisis, what was left was a devastated supply chain; hundreds of thousands of jobs lost; a state energy company with amazing oil assets in a distressed financial situation; and a lot of companies heading for financial distress and bankruptcy. This included Brazilian giants like Odebrecht, Queiroz Galvão and OAS, to name a few.

Brazil’s O&G sector had to be reinvented, as it continues to be. If it weren’t for the pre-salt potential, it would be doubtful whether the sector would ever recover. But a shift in the governmental agenda, a modernization in regulations, and a well-conducted turnaround program at Petrobras created some of the conditions needed for oil production to grow. It is amazing that a geological play, with a 2000+-m water depth far from the coast (150+ km), and with several technological challenges, has reached a level of production that increased Brazil’s total crude oil production by 50% in a bit more than 10 years. We might say that Brazil seems to be moving in the right direction now. Historical production growth and the aforementioned potential production of 5 MMbopd by 2030 can make pre-salt the industry’s most prolific offshore production area, ever, Fig. 3.

To actually fulfill its potential, Brazil has to learn the lessons from the catastrophic events of the first years of the 2010s. The way the market sees it, this learning process has to be faster. Even though the country is definitively moving in the direction of a fully deregulated O&G market (finally trying to enforce the spirit of the Petroleum Law of 1997), this development agenda has to face the structural economic challenges and find a way to overcome them.

THE AMBITIOUS “30 YEARS IN 10” PLAN

The challenges, embedded in this idea of (once again) trying to boost the Brazilian O&G sector as a lever for the entire economy, are amazingly high. It would be correct to summarize this program as a “30 years in 10” effort to speed up the growth process. But it is highly questionable whether the ambitions of the government/industry are in synch with the country’s and the industry’s capabilities. Surely, there are solutions that can be deployed to make the 2020s a much better decade for the industry. But many things have to be addressed from a different and more creative perspective.

Requirements. In other words, there are several initiatives in place to boost the O&G sector. Each one is a major challenge to execute. Addressing all of them at the same time does seem unachievable. Prioritization is needed, as well as governmental support, in the form of tax reforms, and a stable regulatory framework. Industry capabilities will actually set the pace of the “30 years in 10” program. It is a key component that all the main players (operators, equipment/service providers) take a lead in the process and seek a level of cooperation, so at least some of these challenges can be overcome. Also, private investment will be needed to support O&G sector growth. It will only happen, if the Brazilian economy presents positive expectations regarding its strengthening in this next decade.

What follows are the main elements of the “30 years in 10” program.

PETROBRAS DIVESTMENT PLAN

There is a plethora of parallel initiatives for the O&G arena today that will have to overcome many challenges. As previously mentioned, ambitions and capabilities are not in synch, but the good news is that there are solutions. Not easy ones, but there are no problems that can’t be solved.

Divestment/investment. The backbone of this ambitious program is Petrobras, in two ways—total focus on the pre salt development, and a portfolio optimization leading to a huge divestment program that may reshape the local industry. Yet, the underlying idea is to create a competitive market in Brazil, in almost all the parts of the value chain, and to create conditions for investments and operations in the O&G value chain to be carried out with the support of an efficient and sustainable local supply chain.

Petrobras’ divestment program has become more tangible and aggressive since 2017. Divestments in several directions were executed and continue to be executed, such as assets outside Brazil (mostly downstream Latin America and some upstream, e.g Africa); natural gas onshore infrastructure (some transportation pipelines and equity positions in local distribution companies); distribution (divestment in distribution of oil products by decreasing the equity position in BR Distribuidora and sale of LPG distributor Liquigás); the bidding process to sell mature onshore and offshore oil fields; and the “crown jewel” (that has the biggest potential impact in reshaping the market), the sale of eight refineries (50% of Brazilian refining capacity).

All of this program is within the context of specific legislation, but there also is a broader body of laws and regulations that circumscribes this program. Looking at the past, we can’t say that the program has been a total success—few big deals, a very painful divestment process to formally transfer asset ownership, and several divestment attempts did not attract interest from the market. Today, the process has been highly focused on the sale of the refineries, an endeavor that has been slightly delayed, given current coronavirus pandemic consequences in the business environment. In addition, recent sales of older onshore and offshore producing fields are also moving forward.

The bidding process for assets is complex, and there are less than 10 successful relevant cases of actual asset ownership transfer; however, the concept of divestment seems to be irreversible. With the sale of the refineries (maybe not all of them will actually attract potential buyers), it will gain a lot of momentum, and maybe by 2025, the refining business (and adjacent businesses) will finally be reshaped, Fig. 4.

The “new equilibrium” is an open question. Will there be capacity expansion, as needed, if Brazilian demand grows, or will Brazil become a “trading country,” possibly trading 2.5 MMbpd of crude oil and oil products in 2025? This is absolutely incompatible with current logistical infrastructure in Brazil.

What is required to tackle this issue has not been addressed so far. In the past, Petrobras always coordinated this process and actually deployed these investments. But in a market with many more players, who do not necessarily have aligned interests, what will happen? It creates big opportunities for investments in infrastructure by specialized players, but will it make economic sense, given the fragilities of the Brazilian economy and uncertainties in the O&G market, itself?

This refining divestment process, which also can be applied to natural gas assets, has a couple of tricky issues. The most relevant one is the fact that there is only one company in Brazil that can operate O&G logistical assets in the country—Petrobras subsidiary Transpetro. It is easy to understand that not only the refineries/gas pipelines are being sold, but the logistics O&M service is also being sold. In the short-to-medium term, while no other entrants can provide these services, this “bundle sale” is inevitable. And, if we imagine that Petrobras decides to divest offshore pipelines, new service providers entering the market become a bigger problem: how long will it take to learn how to operate pipelines in a 2,000-m water depth?

The good news among all these challenges is that the demand for investment in the adjacent activities of the O&G downstream can also take place. There is no reason to doubt the process, only its speed. The speed has to do with more simple processes, government creating a more friendly business environment for investments, and how the Brazilian economy will fight all the economic recessive pressure that will happen after the coronavirus pandemic.

PRE-SALT DEVELOPMENT PLANS

Not only Petrobras but all the other players that have working interests in pre-salt assets are totally focused on pre-salt production increases. The coronavirus pandemics and its effects do not alter the pre-salt story.

Development going forward. We can expect a slower pace of development, given reduced cash flow generation at potential lower oil prices, and from more stringent conditions to access the debt market. But the economics of pre-salt, even at $45/bbl, Brent, are NPV-positive, given very low opex associated with well productivity—one can fill a 150,000-bopd capacity FPSO with only six wells. At $60/bbl, Brent, it is possible that 15 to 20 new FPSOs will be installed in the pre-salt by 2030, and production might reach 4-5 MMbopd.

Before the pre-salt, Brazil had only one super giant field, Roncador. Now, there are three other super-giant fields (Tupi, Búzios and Mero) in production, and possibly this number could more than double by 2030. But there are two big underlying conditions linked to the crude oil production of the pre-salt that we cannot take for granted.

Carbonate challenges. In geological terms, pre-salt reservoirs are carbonates, quite different to manage than the sandstones Petrobras has been discovering and developing since the late 1970s. Carbonate reservoirs can be very tricky. It is understood that the pre-salt fields have so much oil that production decline is not a short-term issue. But the capacity to keep carbonate reservoirs pressurized and producing at low decline rates in the medium-to-longer term may become a very challenging task. And it is not 100% proven that current natural gas and water reinjection in the pre-salt producing areas is helping to postpone the eventual decline challenge.

Natural gas situation. This brings us to the top three topics in Brazil: what we call the “natural gas puzzle.” Brazil never paid much attention to natural gas. Production was always from associated gas fields with low volumes, too low to make a difference in a continental-sized country. In the early 2000s, this picture started to change. Reliability of the hydropower generation system and the discovery of non-associated gas fields have put natural gas on the map in Brazil.

The country has built infrastructure to import elevated volumes of natural gas from Bolivia to serve gas-fired power plants, and also to support southeastern Brazilian industries moving from fuel oil to natural gas as a source for power generation. The production from non-associated gas fields has given more traction to the natural gas market. On top of that, some LNG terminals were built to secure supply, in case of eventual domestic shortages. But the possibility of natural gas becoming REALLY relevant for Brazil’s energy matrix is an adjacent condition to the discovery of the pre-salt.

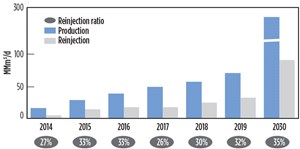

Natural gas volumes in the pre-salt are truly relevant. Most of the fields are oil fields, but an oil field with 8 Bbbl and 15% natural gas content means a lot of natural gas. There are fields where the reserves are incredibly rare and challenging to develop—50:50 crude oil and natural gas. The huge capex associated with the infrastructure to take pre-salt natural gas to shore and deliver it e.g. to the grid, alongside a very heavy tax burden both on the production and consumption sides, will make it very hard to unlock potential demand for natural gas. This lack of cost-competitiveness, together with technical requirements related to field production management, is leading to a massive natural gas reinjection rate that if maintained over a long period of time, may result in several Bcm of natural gas in the pre-salt fields ending up stranded. This also may negatively affect crude oil ultimate recovery in some pre-salt areas, Fig. 5.

Recently, Petrobras and other majors have announced plans to build “jumbo FPSOs” (220,000 bpd of crude oil processing capacity). The lack of parallel announcements of additional natural gas offshore infrastructure leads us to believe that reinjection is the decision for the oil companies on natural gas, within the current business landscape, as explained above. A relevant and mature natural gas market in Brazil seems even more unlikely to happen.

Many levers have to be pulled to solve this puzzle. Potential initiatives include:

- Review of the local content rules that focuses on upstream capex

- Review the elevated tax burden on the natural gas value chain

- Develop “innovative” regulation for natural gas infrastructure, especially offshore pipelines and processing gas facilities

- A higher level of coordination among the partners in the development and operation of each pre-salt field.

This last item will provide more suppliers in the market. And this is key to unlocking the demand for natural gas: if there isn´t diversification in the natural gas supply and, therefore, price competition, all other initiatives to promote competitiveness in the value chain will not be successful.

Local content rules. Among the topics already mentioned, it is necessary to mention that local content regulation was reviewed in the last couple of years, and it was partially softened for production development capex. The previous version of this regulation required local content for new developments (basically pre-salt) at a marginal rate of 50% to 55% over total capex. Operators could ask for waivers, if they could prove that a specific part of the project could not be done in Brazil from a technical and/or economic perspective. But these waivers were very rare, maybe because it was a discretionary decision by the regulator.

After intensive negotiation, local content marginal rate for production development capex dropped to 40%, and the right to ask for waivers was removed from the menu of possibilities. The 40% level could be a reasonable number for a supply chain already mature and with enough capabilities to serve all parts of project development. Today, since the supply chain is still very immature, and faced with an ambition of 15 to 20 FPSOs in the next 10 years, and all the additional investment to be deployed in the fields divested by Petrobras, this number is still too high, Fig. 6. It probably will lead to delays mainly in the delivery of offshore upstream projects.

As an example, the main lever for job generation in the O&G context is shipyard work. In Brazil, there are maybe two or three shipyards that are competitive and can accommodate some FPSO construction stages, but none of them can build 100% of an FPSO. The naval industry in Brazil, for all types of vessels and upstream production facilities, has a long way ahead of it.

Finally, if one does some reverse calculations, natural gas ex-transportation tariffs and ex- consumption taxes at a price above $4 to $5/MMbtu will never unlock relevant demand for natural gas in Brazil. And if we look at neighboring countries like Argentina, with its shale potential in the Vaca Muerta play, pre-salt natural gas can end up being stranded forever, if good decisions are not made today.

The high-level confidence on the executive relationship established along the process was crucial for such agreement to happen, given the fact that it has been signed on July 2004, almost one year before the launch of the satellites itself, on February 2005. That kind of deal known as a pre-launch agreement.

If your company is interested in participating in business opportunity such as these, we would be more than glad to act as your bridge into Brazil.

Always count on the widely respected experience and networking of MEREGE Consulting Partners to reach out to the right people at the right time.

Please, check out the KEY ON-GOING BUSINESS CASES :

BUSINESS CASE FAB / TELEBRAS “SGDC-1 / SGDC-2 plus TT&C COPE”

BUSINESS CASE FAB / AEB “ALCANTARA launching base”

BUSINESS CASE INPE REMOTE SENSE SATELLITE “CBERS”

BUSINESS CASE INPE REMOTE SENSING SATELLITE “AMAZONIA-1”

BUSINESS CASE FAB – CARPONIS-1 / HR Remote Sensing

BUSINESS CASE SMART AGRICULTURE – NB-IoT

BUSINESS CASE MB “UNMANNED AIRCRAFT”

BUSINESS CASE MB “ANTI-SHIP MISSILES”

If your company is interested in to participate on this business opportunity, we would be more than glad to bridge you in.

Also, get the safest and strongest legal advisory through MEREGE Legal & Regulatory team.

Always count on the widely respected experience and networking of MEREGE Consulting Partners to reach out to the right people at the right time.